Enterprise Zones

The Town of Bedford administers an Enterprise Zone under the Virginia Enterprise Program. The designation provides opportunities for the use of state and local enterprise zone incentives to help create new jobs, promote private investment and improve overall economic growth. For more information, please contact the Office of Economic Development at (540) 587-5670 or https://www.dhcd.virginia.gov/vez.

Technology Zones

In the New London Business and Technology Center, Bedford County offers technology companies a tax abatement program on a graduated basis. The maximum possible is 60%-70% (on either machinery and tools tax or business furniture and fixtures) for up to two years, then decreasing to 40%-50% for the next two years, and 20%-30% for the final year or two. Companies must pre-qualify for this program, and amounts vary based on data presented.

Foreign Trade Zones

Foreign Trade Zone #238 (via the Virginia TradePort)

Bedford County became an affiliate of Foreign Trade Zone #238 through the New River Valley Alliance in 2012, allowing our international companies the opportunity to take advantage of these benefits where possible:

- Delay payment of U.S. Customs duties until goods leave the zone to enter U.S. markets.

- Pay duty only on the value of imported components when a company uses a combination of domestic and imported materials to manufacture or process goods within the zone.

- Reduce or eliminate U.S. Customs duties and fees on goods that a company re‐exports.

- Hold excess goods in the zone to avoid import quota restrictions, and release them during the next quota period.

- Transfer in‐bond merchandise between zones for manufacturing and defer duty.

- Pay reduced or no duties on nonconforming, damaged, or scrapped goods.

Please contact the Bedford County Office of Economic Development for further details about the Foreign Trade Zone agreement and how it may help your company.

Opportunity Zones

Qualified Opportunity Zones are low-income census tracts [IRC Section 45D(e)] that were nominated by the governor of Virginia and certified by the U.S. Treasury where new investments may be eligible for preferential tax treatment if they meet certain qualifications. A low-income census tract is defined as having an individual poverty rate of at least 20 percent or a median family income no greater than 80 percent of the area median income. According to the 2015 and 2016 U.S. Census data, Virginia had 901 eligible census tract, and per the Tax and Jobs Act, Virginia was only able to nominate 25 percent or 212 tracts and could have up to five percent or 11 as contiguous tracts. Virginia nominated 212 out of 901 tracts. The designations are permanent until Dec. 31, 2028.

What are Qualified Opportunity Funds?

- Private-sector investment vehicles that invest at least 90 percent of their capital in Opportunity Zones.

- Must be set up as a partnership or LLC.

- A taxpayer must self-certify on their tax return by completing a form to create an Opportunity Fund. A draft form has been released by the U.S. Treasury.

- Equity investment is derived from an investor’s capital gains from a prior investment.

What are the benefits from investing in a Qualified Opportunity Zone Business or Property?

- Temporary tax deferral of capital gains reinvested into a Qualified Opportunity Zone Fund. The deferred gain must be recognized on the earlier of the disposition of the investment or Dec. 31, 2026.

- Step-up in basis, which the initial basis in a Qualified Opportunity Zone investment starts at zero. The basis increases by 10 percent with a holding period of five years, and by an additional 5 percent if held for at least seven years, excluding up to 15 percent of the original gain from taxation.

- Permanent exclusion from taxable income of capital gains from the sale or exchange of an investment in an Opportunity Fund if the investment is held for at least 10 years. The basis of investment at the time of sale is increased to the fair market value.

What types of initiatives can Opportunity Funds be used for?

- Qualified opportunity zone stock acquired after Dec. 31, 2017

- Capital or profits interest in a domestic partnership acquired after Dec. 31, 2017

- Qualified opportunity zone business property acquired after Dec. 31, 2017

- Qualified opportunity zone business

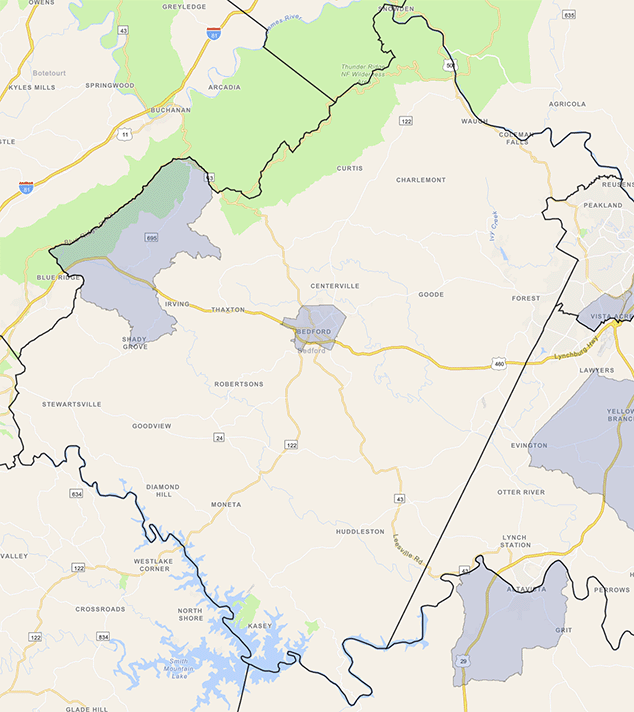

Bedford County Opportunity Zone map:

For complete details about Opportunity Zones in Virginia, please visit the DHCD website, or view the interactive map.